Your health is your most valuable asset, and it deserves to be protected with the best possible care. At Care Health Insurance, we understand the importance of having a comprehensive and affordable health insurance policy that covers your basic healthcare needs. Introducing the Arogya Sanjeevani Policy, a standardized health insurance product mandated by the Insurance Regulatory and Development Authority of India (IRDAI), designed to provide you and your family with essential healthcare coverage at an affordable cost. With our policy, you can access quality healthcare services without worrying about the financial burden of medical expenses.

Our policy offers standardized coverage for hospitalization expenses, surgeries, treatments, diagnostic tests, medications, and more, ensuring that you and your family receive essential healthcare services without financial worries.

Benefit from affordable premiums that provide you with comprehensive coverage without straining your budget. Our policy offers value for money, making healthcare more accessible and affordable for everyone.

Our policy does not have any co-payment requirement, ensuring that you receive the full coverage amount without any additional out-of-pocket expenses.

Enjoy hassle-free cashless treatment at our extensive network of hospitals and healthcare providers across the country. Access quality healthcare services without worrying about upfront payments or reimbursement hassles.

Our policy offers no room rent limits, allowing you to choose hospital rooms according to your preference and comfort without any restrictions.

Choose from a range of sum insured options to suit your healthcare needs and budget. Customize your coverage to ensure that you and your family are adequately protected against unforeseen health emergencies.

Avail tax benefits on your premium payments under Section 80D of the Income Tax Act, making it a tax-efficient investment for your future.

Invest in your health and secure your financial future with the Arogya Sanjeevani Policy from Care Health Insurance. Contact us today to learn more about our policy features, premium rates, and enrollment process. Our dedicated team of insurance experts is here to guide you through every step of the way and help you find the right coverage that meets your healthcare needs.

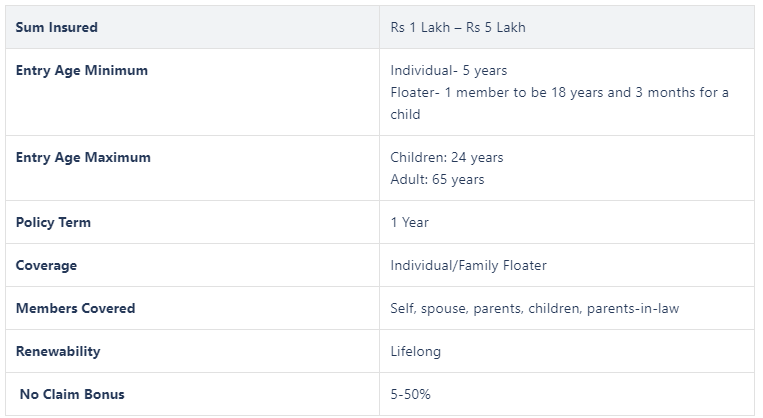

Arogya Sanjeevani policy by Care Health is a standardised product that offers basic hospitalisation cover to the customers. The policy was commenced from April 01, 2020 and is provided by all the insurers including Care Arogya Sanjeevani Policy (Formerlly known as Religare Arogya Sanjeevani Policy) provider. The policy is ideal for those who cannot afford a higher premium and the coverage amount is between Rs 1 lakh and Rs 5 lakh. Check out what the Care Health Arogya Sanjeevani Policy has to offer:

Some of the prominent features of this policy are given below:

• People above the age of 65 years can buy the policy for their family members if not self

• The coverage amount ranges from Rs 1 lakh to Rs 5 lakh

• Arogya Sanjeevani plan offers coverage on both individual and on family floater basis

• If you are between the age group of 18 and 65 years, then you can buy this plan

• And your children between the age group of 3 months and 25 years are also eligible to be covered under the same plan

• Care Health provides a grace period of 30 days to renew the Arogya Sanjeevani policy, which needs to be renewed on an annual basis

• A co-payment of 5% applies to all the claims, which means that the policyholder needs to pay an amount equal to 5% of the medical expenses

• Arogya Sanjeevani Policy does not provide an add-on or optional covers

• However, Care Health Arogya Sanjeevani plan offers a special cover for dental expenses and plastic surgery due to an illness or injury

Eligibility Criteria for Care Health Arogya Sanjeevani Policy

• Pre-existing diseases are covered after a waiting period of 48 months

• 30-days initial waiting period shall apply for all illnesses except for injuries

• Some of the diseases can only be covered after a waiting period of 24 months

• 5% co-payment clause is applicable on all the claims