The Elite Advantage Plan combines investment opportunities with life insurance coverage, where policyholders pay regular premiums for a specified period, investing in various funds or options. Benefits upon maturity or demise include the accumulated investment value along with bonuses. It offers flexibility in premiums, investment strategies, and optional riders, making it a versatile choice for financial security.

It provides a platform for investing in various funds or investment options, allowing policyholders to potentially grow their wealth over time.

Along with investment opportunities, the plan also offers life insurance coverage, providing financial protection to the policyholder's family in case of untimely demise.

Upon maturity, the plan offers benefits that include the accumulated value of investments along with any accrued bonuses or returns, providing a substantial financial payout.

The plan offers flexibility in terms of premium payments, investment strategies, and the option to add riders for enhanced coverage, allowing policyholders to tailor.

Premiums paid towards the Elite Advantage Plan may be eligible for tax benefits under Section 80C of the Income Tax Act, providing additional savings.

Premium Payment:

Investment Allocation:

Life Insurance Coverage:

Maturity Benefit:

Flexibility:

Optional Riders: Depending on the plan variant, policyholders may have the option to enhance their coverage by adding riders such as accidental death benefit rider, critical illness rider, etc., for an additional premium.

| PARAMETER | CRITERIA | ||

| Premiums @ Global (Rs.) | Premium (Rs.) | Base Premium | GST |

| 6500(Hly | 6221 | 280 | |

| 13000 | 12440 | 560 | |

| 26000 | 24880 | 1120 | |

| 52000 | 49761 | 2239 | |

| 99000 | 94737 | 4263 | |

| 104000 | 99522 | 4478 | |

| Minimum age at entry | 6 Years |

| Maximum age at entry | 65 years |

| Maximum age at maturity | 77 years |

| PPT & Policy Term | 12 years |

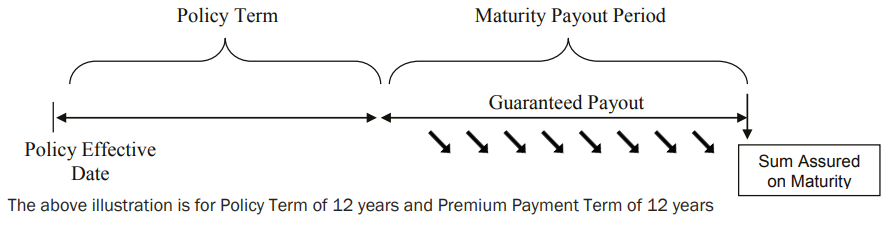

Bharti AXA Life Elite Advantage is a traditional non-participating savings & protection oriented plan. You pay premium for the chosen Premium Payment Term. At the end of Policy Term, the Maturity Benefit Period will start during which Guaranteed Payouts will be paid from the end of the Policy Term until the end of the 19th year. At the end of the 20th year, 100% of the Sum Assured on Maturity will be paid to the Policyholder.

Maturity Benefit

If the Life Insured survives till the maturity of the Policy and all premiums are duly paid, then the benefits, as mentioned below, will be paid to the Policyholder

1. Guaranteed Payout

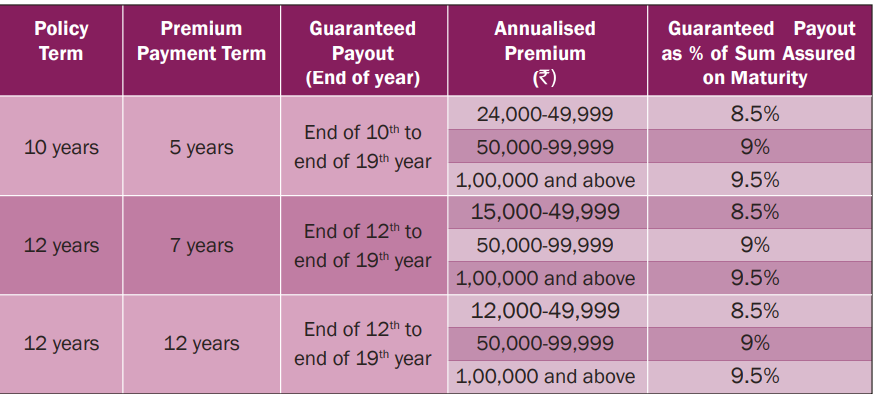

A percentage of Sum Assured on Maturity is paid during the Maturity Payout Period starting from the end of the policy term till the end of the 19th year. The frequency of the guaranteed payout will be Annual/Semi-Annual/Quarterly as chosen by the Policyholder.

2. Sum Assured

100% of Sum Assured on Maturity is paid at the end of 20th year from the Policy Date. The percentage of Guaranteed Payout depends upon the Policy Term, Premium Payment Term and the Premium Amount as mentioned below:

In case of the unfortunate event of death of the Life Insured during the Policy Term, the following benefits will be payable to the Nominee, subject to Policy being in force. The Sum Assured on death will be the higher of:

1) Sum Assured on Maturity, or

2) 11 times Annualized Premium, or

3) 105% of all premiums paid (excluding any additional charges as levied by the In the event of death of the Life Insured:

a. During the grace period allowed for payment of due premiums: The Death Benefit (after deducting the unpaid due Premium) shall be payable

b. While the policy is in lapse status: No benefit shall be payable

c. When the policy is in paid up status: Paid up value on death will be payable

4) During the Maturity Payout Period: No Death Benefit shall be Payable in case of the death of the Life Insured during the Maturity Payout Period. The unpaid Guaranteed Payout will be paid to the Nominee as per the Schedule mentioned in the Maturity Benefit section and the Sum Assured on Maturity will be paid at the end of 20th year.