The Bharti Axa Secure Income Plan is a comprehensive life insurance policy designed to provide financial security and stability to you and your loved ones. This plan offers a unique combination of life cover and guaranteed regular income, ensuring that your family's financial needs are met, even in your absence.

The plan offers a robust life cover to ensure that your family's financial needs are taken care of in the event of your untimely demise, providing them with the necessary financial security and stability.

With the Secure Income Plan, you can enjoy guaranteed periodic income payouts, helping to replace your lost income and support your family's living expenses, financial goals, and lifestyle maintenance.

The plan provides flexible payout options, allowing you to choose the frequency of income payouts (monthly, quarterly, half-yearly, or yearly) based on your convenience and financial requirements.

The Secure Income Plan is eligible for tax benefits under Section 80C and Section 10(10D) of the Income Tax Act, 1961, allowing you to save on taxes while securing your family's future.

You can enhance your coverage by opting for additional riders such as Accidental Death Benefit, Critical Illness Benefit, and Waiver of Premium, providing extra protection.

The plan offers competitive premium rates, making it an affordable and cost-effective life insurance solution tailored to meet your financial needs and objectives.

Choose Your Coverage:

Select the Policy Term:

Premium Payment:

Accrual of Benefits:

Guaranteed Regular Income:

Optional Riders (If Opted):

Maturity Benefit:

Tax Benefits:

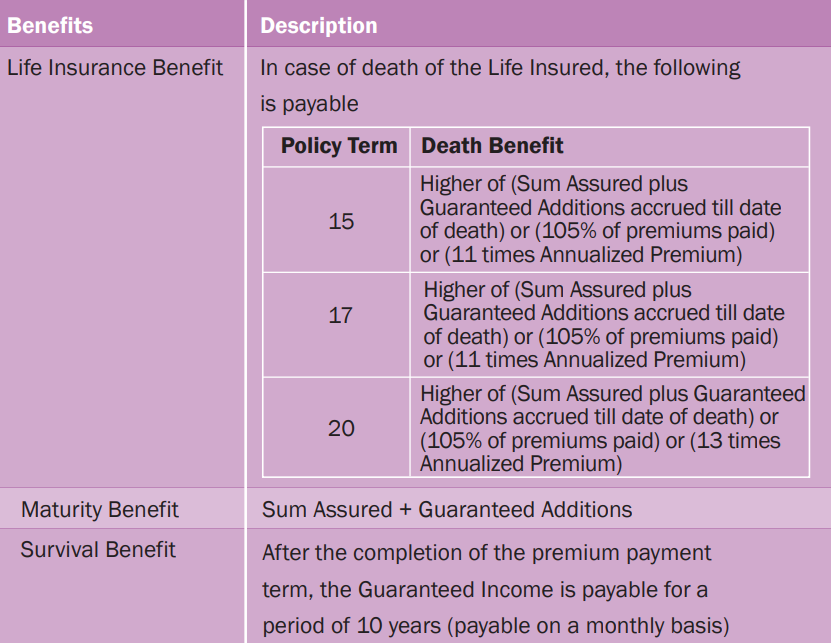

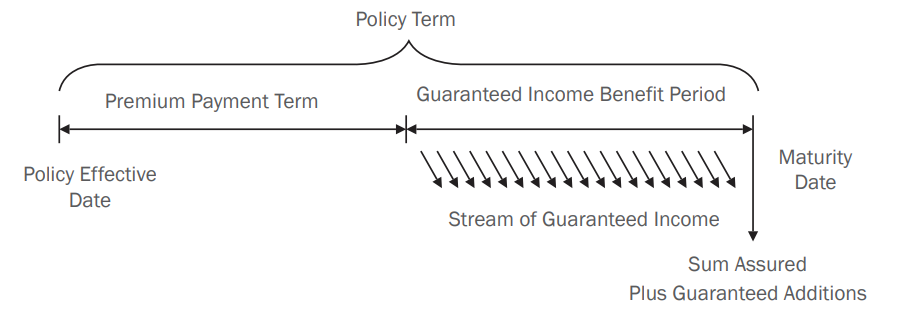

Bharti AXA Life Secure Income Plan is a Limited premium payment, traditional non participating plan. You pay premium for the chosen Premium Payment Term. At the end of this term, you start receiving your Guaranteed Income until Maturity. On Maturity, you receive Sum Assured plus Guaranteed Additions depending upon the policy term chosen.

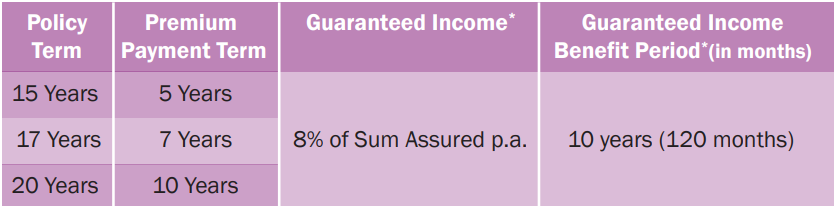

Your Guaranteed Income is calculated based on your chosen Sum Assured. You have the flexibility to choose your Policy term from 3 options. The corresponding Premium Payment Term, Guaranteed Income and Guaranteed Income Benefit Period for each policy term are as below:

The Guaranteed Income commences after the end of Premium Payment Term and will be paid out on a monthly basis

Premium amount applicable to you will be dependant on your age, policy term, premium payment mode and chosen Sum Assured.

Premium payment mode: You can choose Monthly, Quarterly, Semi-annual or Annual Premium. Monthly Premium = 0.09 of Annual Premium, Quarterly Premium = 0.27 of Annual Premium, Semi-annual Premium = 0.52 of Annual Premium.

Benefits at a glance