The Shining Stars Child Plan from Bharti Axa Life Insurance is a specialized life insurance policy designed to secure your child's future by providing financial support for their education, marriage, and other life milestones. This comprehensive child plan offers a unique blend of life cover, savings, and investment options to ensure that your child's dreams and aspirations are fulfilled, even in your absence.

The plan offers a comprehensive life cover for parents, ensuring financial security for the family and providing a safety net in the event of the unfortunate demise of the policyholder. This ensures that your child's future remains secure and unaffected, allowing them to continue their education and maintain.

The Shining Stars Child Plan combines savings and investment components to help you build a substantial corpus over time. This corpus can be utilized to fund your child's education, marriage, and other important life events, ensuring that they have the necessary financial resources to achieve their goals and aspirations.

The plan offers flexible payout options, allowing you to choose between lump-sum payment, periodic income, or a combination of both, based on your child's future financial needs and your financial planning goals. This flexibility ensures that you can tailor the plan to meet your specific requirements and provide the best possible support to your child.

In the unfortunate event of the demise or disability of the parent (policyholder), the Shining Stars Child Plan offers a premium waiver benefit, ensuring that the policy continues and the child's financial future remains unaffected. This feature provides an additional layer of security and peace of mind.

The Shining Stars Child Plan is eligible for tax benefits under Section 80C and Section 10(10D) of the Income Tax Act, 1961. By investing in this plan, you can avail tax deductions on the premiums paid and tax-free returns on the maturity or death benefits received, helping you save on taxes while securing your child's future.

The plan offers guaranteed additions and bonuses to boost your savings and investment corpus, helping you achieve your financial goals faster and secure a brighter future for your child. With competitive returns and growth potential, the Shining Stars Child Plan ensures that your investments work hard.

Choose the Sum Assured and Policy Term:

Select the Premium Payment Frequency:

Accrual of Benefits:

Guaranteed Regular Income:

Maturity Benefit:

Tax Benefits:

| Parameter | Eligibility Criteria | Maximum | |

|---|---|---|---|

| Premiums @ Global (Rs.) | Premium (Rs.) | Base Premium | GST |

| 8001 | 7656 | 345 | |

| 10000 | 9569 | 431 | |

| 15999 | 15310 | 689 | |

| 25000 | 23923 | 1077 | |

| Minimum age at entry | 18 Years | ||

| Maximum age at entry | 60 years | ||

| Premium Payment Term & Policy Term for Premium 8001 | 12 yrs & 17 yrs | ||

| Premium Payment Term | 10 vrs, 11 yrs, 12 yrs, 13 vrs, 14 vrs, 15 vrs | ||

| Policy Term | 15 yrs 16 yrs, 17 yrs, 18 yrs, 19 yrs, 20 yrs | ||

| Maximum age at maturity | 80 years | ||

Anil does not want to be constrained by the payout options that he chooses at the time of inception of the policy, hence, he decides to purchase Bharti AXA Life Shining Stars where he can choose to change the benefit options even at the time of Maturity. He decides to take a policy term of 15 years for which the premium payment term is 10 years. He decides to pay a premium of 50,000 p.a. (exclusive of taxes) for which the Sum Assured is 7,42,501. He pays the premium for 10 years.

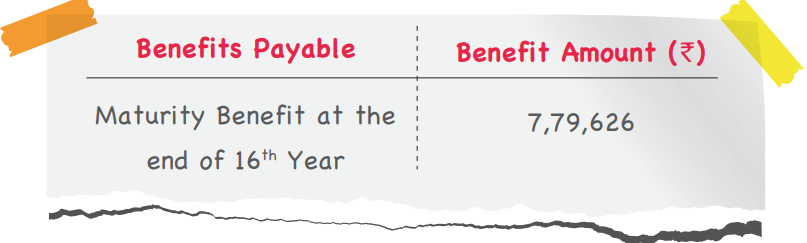

Flexi Payout Option: Under this option, Anil is entitled to receive the entire Maturity Benefit as 100% of the Sum Assured i.e 7,42,501 at the end of the 15th year. However, Anil decides to receive the Maturity Benefit as a lumpsum amount at the end of the 16th year, so that he can pay for his child’s higher education expenses when his child turns 18 year old.

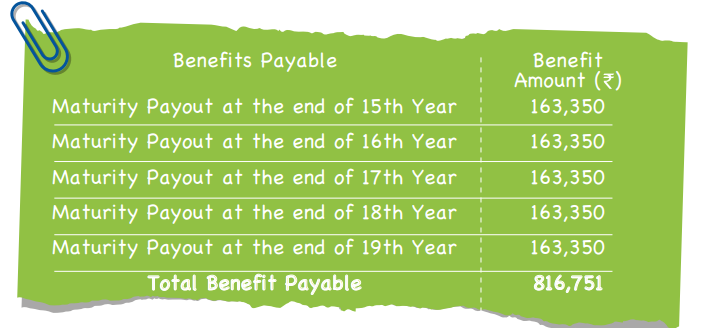

When Anil decides to receive annual payouts for 5 consecutive years to support the yearly educational expenses which may occur due to rising inflation or for any other purpose

In case of death of Anil during the policy term, his family would receive death benefit as higher of:

• 11 times Annualized Premium

• 105% of all premiums paid as on date of death

• Absolute amount assured to be paid on death equal to the Sum Assured

• Sum Assured on Maturity, equal to the Sum Assured under the policy

In case Anil dies during the premium payment term, Anil’s nominee would receive Death

Benefit and the Maturity Benefit would also be payable at the time of Maturity with no further

premiums to be paid.