At Star Health Insurance, we prioritize the well-being of you and your loved ones. That's why we're proud to introduce our Family Health Optima Accident Care Policy, designed to provide comprehensive coverage and financial security in the event of accidents.

Our Accident Care Policy offers extensive coverage for accidental injuries, including hospitalization expenses, medical treatments, surgeries, ambulance services, and more.

Accidents can happen unexpectedly, leading to significant financial burdens. With our policy, you can rest assured knowing that you and your family are financially protected against unforeseen accidents.

We understand that every family's needs are unique. That's why we offer flexible coverage options that can be customized to suit your specific requirements, ensuring that you receive the protection you need without paying for unnecessary coverage.

In the unfortunate event of an accident, we strive to provide prompt and hassle-free claim settlement, ensuring that you receive the necessary funds to cover medical expenses and other related costs.

Our dedicated customer support team is available round-the-clock to assist you with any queries or concerns you may have regarding your policy, claims process, or coverage details.

Key Features of Family Health Optima Accident Care Policy

Get Protected Today

Don't let accidents catch you off guard. Safeguard your family's financial future with the Family Health Optima Accident Care Policy from Star Health Insurance. Get in touch with us today to learn more about our policy features, coverage options, and premium rates. Our friendly insurance experts are here to help you find the right coverage that fits your needs and budget.

Experience peace of mind knowing that you have comprehensive accident coverage with Star Health Insurance. Protect your family today and enjoy life worry-free.

Who can take this insurance?

Any person aged between 18 years and 65 years can take this insurance for his/her family consisting of Self, Spouse / Live in partner / Same Sex partner and dependent children not the exceeding three in number, dependent Parents and dependent Parents-in-law. Beyond 65 years, only renewals are allowed. Dependent children are covered from 16 days of its birth till expiry of the policy subject to the limits mentioned in the policy. If, at the commencement of the policy, the new born child is less than 16 days of age, the proposer can opt to cover such new born child also in the same policy by paying the applicable premium in full. However, the cover for such newborn children will commence only from the 16th day of its birth and will continue till the expiry date of the policy. Maximum age limit for coverage of dependent children is 25 years.

Type of Policy: Floater

Sum Insured Options: Rs.3,00,000/-, Rs.4,00,000/-, Rs.5,00,000/-, Rs.10,00,000/-, Rs.15,00,000/-, Rs.20,00,000/- and Rs.25,00,000/-

Note: Sum Insured options of Rs.1,00,000/- and Rs.2,00,000/- are available only for renewals

Pre-acceptance medical screening: All persons above 50 years of age and those who declare adverse medical history in the proposal form are required to undergo pre-acceptance medical screening at the Company designated Centers. At present 100% of the cost of medical screening is borne by the Company. The age for Health screening may be scaled downwards or upwards. Due advance information will be given to the customer.

Policy term: One year / Two year - For policies more than one year, the Basic Sum Insured is for each year, without any carry over benefit there of

Long term discount: If the policy term opted is 2 years, discount available is at 10% on 2nd year premium.

Upfront Discount:We will provide an upfront discount of 5% on the premium, if the following additional questions related to lifestyle and habits are answered by the insured at the time of purchasing this policy.

Note

- This discount will be available only on the base policy premium not on Optional/Add-on covers.

- This discount will be available only once, that is at the time of first purchase of this policy and if purchased online.

- The discount will be given only if all the Adult Members proposed for Insurance answered the questions

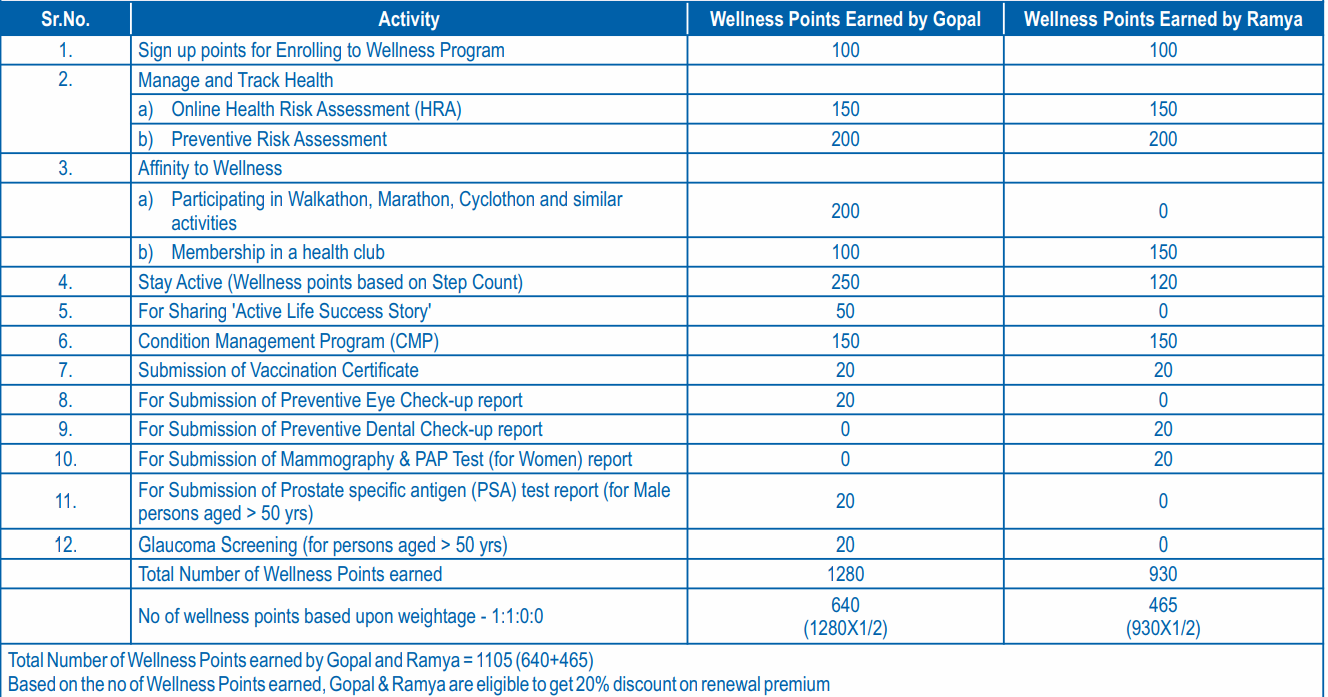

What are the benefits available under the insurance?