Global Finsol understands the importance of securing the future of our young stars. That's why we're proud to introduce the Young Star Insurance Policy, a comprehensive insurance solution tailored to meet the evolving needs of today's youth. Whether you're a student, a young professional, or a budding entrepreneur, our policy offers the protection and peace of mind you need to pursue your dreams with confidence.

Our Commitment

With the Young Star Insurance Policy, our commitment is to empower the next generation to thrive and succeed, no matter what life throws their way. We believe in providing young individuals with the financial security they need to pursue their passions, explore opportunities, and build a bright future for themselves.

We understand that young individuals have unique needs and aspirations. That's why our Young Star Insurance Policy offers customizable coverage options to suit your lifestyle, career path, and future goals.

We believe that financial security should be accessible to everyone. Our policy offers competitive premiums designed to fit your budget, so you can protect yourself and your future without breaking the bank.

From health emergencies to unexpected accidents and everything in between, our policy provides comprehensive coverage to safeguard you against life's uncertainties. benefits like hospitalization.

Whether you're looking for basic coverage or additional benefits like critical illness cover or personal accident cover, we offer flexible policy options to meet your individual needs and preferences. Choose the coverage amount and duration that works best for you.

Key Features

Health Cover:

Accidental Death Benefit:

Critical Illness Cover:

Personal Accident Cover:

Get in Touch

Secure your future with the Young Star Insurance Policy by Global Finsol. Contact us today to learn more about our policy options and find the right coverage for your needs. With our commitment to affordable premiums, comprehensive coverage, and dedicated customer service, you can trust us to be your partner in financial security and success.

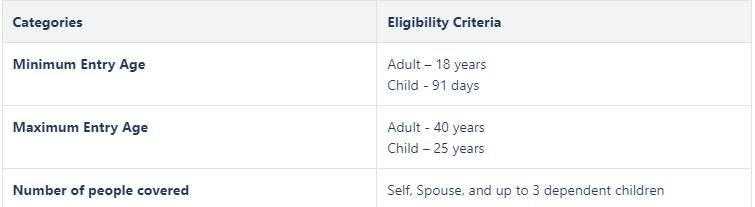

Star Young Star Insurance Policy is a health plan that provides coverage to people up to the age of 40 years. It covers medical expenses incurred due to hospitalization, ambulance charges, automatic restoration, mid-term inclusion etc. It also comes with special features, such as no cap on room rent.

The following is the list of features and benefits that Star Young Health Insurance covers:

• The policy has two plan options- Gold and Silver with multiple sum insured options.

• No capping on room rent allowing treatment at single AC room

• Health checkup expenses are covered

• Hospitalization expenses due to a road traffic accident are covered

• Mid-term inclusion of a newly married spouse or newborn or a legally adopted child is allowed

• 10% savings on premium through Wellness Program is an attractive feature of this policy

• Tax benefits can be availed as per the Income Tax Act.

To cancel the Star Young Star Health Insurance policy, the policyholder can cancel the policy within a 15-day free look period. The amount will be refunded less any expenses incurred by the company or stamp duty charges. If the policy is cancelled after 15 days, the amount will be refunded on a pro-rata basis.