Amidst the global pandemic, ensuring the health and well-being of your organization's members has never been more critical. At Star Health Insurance, we understand the challenges posed by COVID-19, and we're committed to providing comprehensive solutions to protect your organization. That's why we're proud to introduce the Star Group COVID Insurance Policy, a specialized insurance plan designed to offer extensive coverage and peace of mind during these uncertain times.

Our COVID Insurance Policy provides comprehensive coverage for COVID-19-related medical expenses, including hospitalization, ICU charges, quarantine expenses, home care treatment, and more. With generous coverage limits and benefits, your organization's members can access quality healthcare services.

We understand that every organization has unique requirements and challenges. That's why our COVID Insurance Policy offers customized plans that can be tailored to suit your organization's specific preferences and budget constraints. Whether you're a small business or a large corporation.

Enjoy the convenience of cashless treatment at our vast network of hospitals and healthcare providers nationwide. With our network hospitals, your organization's members can receive timely and quality healthcare services without the hassle of upfront payments or reimbursement hassles.

In the event of a COVID-19-related medical expense, we strive to provide prompt and hassle-free claim settlement. Our dedicated claims team works tirelessly to ensure that your organization's members' claims are processed swiftly, allowing them.

Our customer service team is committed to providing exceptional support and assistance to your organization and its members. Whether you have questions about your coverage, need help with claim processing, or require guidance on healthcare services, we're here to help.

Key Features of Star Group COVID Insurance Policy

Protect Your Organization Today

Ensure the health and well-being of your organization's members with the Star Group COVID Insurance Policy from Star Health Insurance. Contact us today to learn more about our policy features, premium rates, and enrollment process. Our dedicated insurance experts are here to help you find the right coverage that meets your organization's needs and supports your members' health and well-being during the pandemic.

Experience the difference with Star Health Insurance's Group COVID Insurance Policy. Protect your organization and its members against the uncertainties of COVID-19 and enjoy peace of mind knowing that their health needs are taken care of.

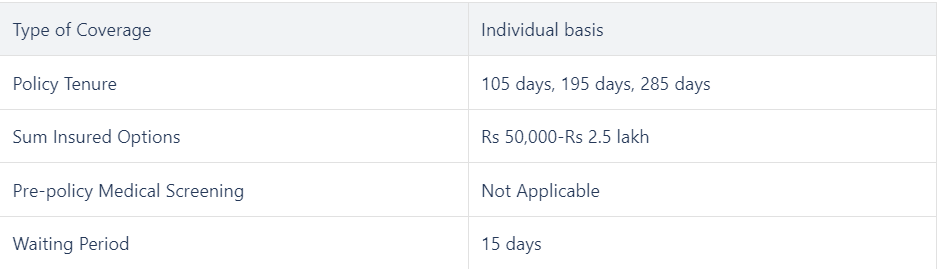

Star Health and Allied Insurance Co. Ltd. offers fixed benefit Corona Rakshak Policy with many shield options to cover the expenses of COVID-19 treatment. The lump-sum payout of the sum insured under Star Corona Rakshak Policy helps the insured to access quality healthcare. The policy comes with attractive benefits such as no TPA involvement, exclusive coverage for Coronavirus, sum insured up to Rs 2.5 lakh etc.

The factors that influence the buy Corona Rakshak Policy are the flexible options of the Sum Insured and multiple policy terms.

• Policy Type: The plan is offered only on an individual basis.

• Renewal: The policy does not offer any renewal facility to the insured.

• Tax Benefit: The premium paid for the Corona Rakshak Policy Health Insurance in modes other than cash is tax-exempt under Section 80D of the Income Tax Act, 1961, subject to applicable limits.

Only the insurer is empowered to cancel the Corona Rakshak Policy by serving a written notice of 7 days on the grounds of misrepresentation, fraud, moral hazards, and non-cooperation. The insurer is not liable to refund the premium for cancellation on grounds other than non-cooperation.