At Star Health Insurance, we prioritize the health and well-being of our customers. We are excited to introduce the Star Out Patient Care Insurance Policy, a comprehensive insurance plan designed to provide coverage for outpatient medical expenses, ensuring that you receive the care you need without financial worry.

Our Out Patient Care Insurance Policy offers coverage for a wide range of outpatient medical expenses, including doctor consultations, diagnostic tests, medications, specialist visits, and more. Whether it's a routine check-up or specialized treatment, our policy.

Outpatient medical expenses can add up quickly, putting a strain on your finances. With our policy, you can have peace of mind knowing that you're financially protected against unexpected outpatient medical costs. Focus on your health and recovery without worrying about the financial burden.

Our Out Patient Care Insurance Policy provides tailored coverage options to meet individual healthcare needs, offering basic or comprehensive protection.

Enjoy the convenience of cashless treatment at our vast network of outpatient healthcare providers. With our network of clinics, diagnostic centers, and pharmacies, you can access quality healthcare services without worrying about upfront payments or reimbursement hassles.

Our dedicated claims team ensures prompt and efficient settlement of outpatient medical expenses, allowing you to focus on recovery.

Key Features of Star Out Patient Care Insurance Policy

Secure Your Outpatient Care Today

Don't let outpatient medical expenses catch you off guard. Invest in your health and financial security with the Star Out Patient Care Insurance Policy from Star Health Insurance. Contact us today to learn more about our policy features, coverage options, and premium rates. Our dedicated insurance experts are here to help you find the right coverage that meets your needs and supports your health journey.

Experience the difference with Star Health Insurance's Star Out Patient Care Insurance Policy. Protect your health and enjoy life worry-free with our comprehensive outpatient coverage.

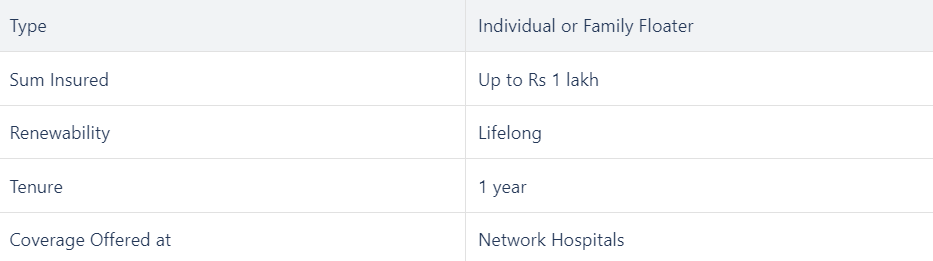

Star Outpatient Care Insurance Policy is available in Individual or Family Floater basis with sum insured amount of Rs 25,000, Rs 50,000, Rs 75,000 and Rs 1 lakh.

The coverage provided are:

Outpatient Consultation: This includes expenses not covered for in-patient specialist visits or day care visits. This considers consultation taken at any network hospital under the insurer.

Expenses for Diagnostics, Physiotherapy, and Pharmacy: The insurance policy covers such costs at a specific diagnostic test or examination to be done at an external laboratory. Additionally, if a patient is recommended physiotherapy treatment for physical injuries, the same will be covered under the policy. Both in-house and external treatment expenses are financed.

The features and benefits of the Star Outpatient Care Insurance Policy are:

• Flexibility of coverage is offered by three different plans – Silver, Gold, and Platinum.

• The waiting period applies for pre-existing ailments; this is variable depending on the plan taken

• Silver – 48 months

• Gold – 24 months

• Platinum – 12 months

In the event of portability, the waiting period is reduced accordingly.

• Upon policy renewal, the waiting period is waived off.

• Claims settlement is done directly by the insurance provider with no third party involvement.

• Policy renewability is lifelong.

• Cashless reimbursement is offered at more than 9900+ hospitals throughout India.

• Tax exemption applies to the premium paid under Section 80D of the Income Tax Act, 1961.

The minimum eligibility criteria to buy this policy are: