Global Finsol is pleased to introduce Star Micro Rural and Farmers Care, an insurance policy specially designed to cater to the unique needs of rural communities and farmers. With a focus on providing affordable and accessible insurance coverage, our policy offers comprehensive protection against various risks and uncertainties that rural households and farmers may face.

Our Commitment

At Global Finsol, we recognize the vital role that rural communities and farmers play in the economy. That's why we're dedicated to providing them with reliable insurance solutions that address their specific needs and challenges. With Star Micro Rural and Farmers Care, we aim to empower rural households and farmers with financial security and peace of mind, ensuring that they can protect their livelihoods and families against unforeseen events.

Our policy is tailored to meet the unique needs of rural communities and farmers, offering coverage for a wide range of risks, including crop failures, livestock mortality, accidents, and more. With customizable options, farmers can choose the coverage.

We understand the importance of affordability for rural households and farmers. That's why we offer competitive premiums that are accessible to all, ensuring that even those with limited financial resources can afford the protection they need.

Our team of insurance experts is dedicated to providing personalized support and assistance to rural policyholders. Whether it's helping farmers understand their coverage options or assisting them with claims processing.

We believe in fostering strong relationships within rural communities. Through our outreach programs and initiatives, we engage with farmers to raise awareness about insurance and empower them with knowledge and resources to make informed decisions about their financial future.

Key Features

Get in Touch

Secure your livelihood and protect your family with Star Micro Rural and Farmers Care by Global Finsol. Contact us today to learn more about our insurance solutions and how we can support you in safeguarding your future. With our commitment to rural communities and farmers, you can trust us to be your partner in resilience and prosperity.

People living in rural areas are usually deprived of fundamental healthcare facilities due to minimum development and a lack of critical infrastructure in clinics and hospitals. To cater to the needs of such individuals and their families, Star has designed Micro Rural and Farmers Care insurance, which is an affordable health insurance policy that saves the insured from several healthcare expenses.

The good thing is that this policy does not require a pre-acceptance medical examination. It makes sure that people and their families who live in rural areas don’t have to sacrifice their health and provides total support when they are admitted to the hospital as a result of an illness or accident.

The plan is packed with unique features and benefits for its policyholders. Here are some of the important highlights of the plan:

• No Pre-Acceptance Medical Screening: Any kind of pre-insurance medical screening or examination is not necessary while purchasing the policy.

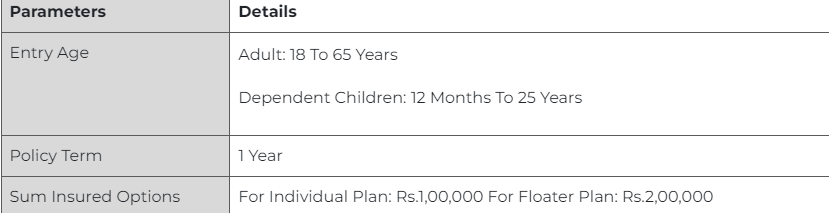

• Flexibility: The plan comes with two flexible variants, namely the Individual and Floater versions. The first version is available for those between the ages of 18 and 65; whereas, the floater version covers the self, spouse, and up to two dependent children (12 months to 25 years old).

• Co-Payment: For new policies as well as policies that are subsequently renewed for insured persons who are 61 years of age or older at the time of admission into this policy, there is a 20% co-payment requirement. This co-payment is not applicable for insured individuals who signed up for the policy before turning 61 and renew it constantly without a gap.

• Free Look Period: The free look period shall only be applicable to new individual health insurance policies; it shall not be applicable to renewals or when a policy is ported or migrated. Following receipt of the policy document, the insured person has fifteen days to evaluate the terms and conditions and return the document if they are not satisfactory.

• Lifelong Renewability: The plan provides a lifelong renewability option to the policyholder.

• Tax Benefits: Section 80D of the Income Tax Act of 1961 provides an exemption for payments made for this insurance in any manner other than cash.