Global Finsol is proud to present Star Group Criticare Platinum, an exclusive insurance policy tailored to meet the healthcare needs of your employees. With comprehensive coverage and flexible benefits, our policy offers financial protection and peace of mind to both employers and employees alike.

Our Commitment

At Global Finsol, we understand the importance of employee well-being and the impact it has on your business. That's why we're committed to providing you with innovative insurance solutions that prioritize the health and happiness of your workforce. With Star Group Criticare Platinum, you can demonstrate your commitment to employee welfare while safeguarding your company's financial interests.

Our policy offers extensive coverage for a wide range of medical expenses, including hospitalization, surgery, diagnostic tests, doctor's fees, medication costs, and more. With flexible benefit options, you can customize the coverage to meet the specific needs of your employees.

In addition to standard medical coverage, Star Group Criticare Platinum offers enhanced benefits such as maternity cover, newborn baby cover, pre-existing condition cover, and organ donor expenses cover, ensuring that your employees have access to the care.

We understand that every organization is unique, which is why we offer tailored insurance solutions that cater to the specific requirements of your business. Whether you're a small startup or a large corporation, we'll work with you to design a plan that aligns with your company's goals.

Our team of experienced insurance professionals is committed to providing exceptional service and support to both employers and employees. From plan selection and enrollment to claims assistance and renewal management, we'll be with you every step of the way to ensure a smooth and seamless experience.

Key Features

Get in Touch

Invest in the health and well-being of your employees with Star Group Criticare Platinum by Global Finsol. Contact us today to learn more about our insurance solutions and how we can help you protect your most valuable asset – your workforce. With our commitment to excellence and dedication to service, you can trust us to be your partner in employee benefits and corporate wellness.

Star Criticare Plus Insurance policy from Star Health Insurance Company aims to offer reimbursement for the expenses incurred due to hospitalization because of sickness, disease, illness, or/ and accidental injury. This plan as well offers lump-sum payment upon diagnosis of some critical illness. This plan offers cover for nine major critical illnesses without any survival period. The sum insured for this policy is as per the covered individual member. Those who are living in India and fall in the age group of 18 years to 65 years are eligible to take Star Criticare Plus Insurance Policy.

This plan offers many benefits to its policyholders, which can be divided into Section 1 and Section 2. In Section 1, the policyholder gets insurance cover for an inpatient hospitalization, cost of medicines and drugs, charges for an emergency ambulance, cost of non-allopathic treatment, etc. On the other hand, in Section 2, the policyholder is offered benefits for the non-survival period, however, the waiting period is applicable, and with hospitalization expenses offered in Section 1and lump-sum compensation and so on are provided.

• Any person falling in the age group of 18 years and 65 years is eligible to take this plan.

• The sum insured for Star Criticare Plus Insurance policy is according to the covered individual member.

• Under Section 1 of the policy, some day-care processes are covered up to a certain limit, which is applicable under Section 1 of the policy.

• Expenses of non-allopathic treatments are covered but up to a specific limit.

• Ambulance charges are also covered but up to a specific limit.

• Pre hospitalization expenses for 30 days before the hospitalization are covered.

• Expenses of post-hospitalization are as well covered and are paid as a lump sum after the policyholder gets discharged from the hospital.

• The major diseases that are covered under Section 2 of the policy are:

• Chronic Kidney Disease, Cancer, Brain Tumour that is undergoing for the first time.

• Acute Myocardial Infarction, Cerebro-Vascular Stroke that has caused Hemiplegia, Established irreversible coma, Established irreversible Quadriplegia, Established irreversible Paraplegia.

• Major organ transplant, occurring for the first time.

• Provides critical illness cover for nine major critical diseases.

• The facility of lump-sum payment is also provided upon the diagnosis of a critical illness.

• The expense for non-allopathic treatments up to a specific limit is also offered.

• The plan has a lifelong renewability feature.

• Upon payment of the lumpsum amount, the insurance cover continues until the policy expires for regular hospitalization.

1. Policy Benefits Under Section 1:

• Expenses of in-patient hospitalization for a minimum of 24 hours are covered. This includes rent of the room, nursing and boarding expenses at the rate of 2% of the Sum Insured that is subject to a maximum amount of Rs.4, 000 every day.

• Consultation fees, surgeon fees, charges of ICU, fees of specialist, and anesthetist.

• Cost of drugs and medicines.

• Provides coverage for modern treatment.

• Ambulance cost up to a certain limit is also covered.

• Ayush cover for a maximum of 25% of the sum insured and a maximum of Rs.25,000/ policy period is paid.

2. Policy Benefits Under Section 2:

• Lump-sum compensation is offered.

• Hospitalization expenses until the diagnosis of critical illness are offered.

• Only one lump sum amount is paid in the lifetime of an insured person.

• There only a waiting period of 90 days from the date of policy inception and there is no survival period.

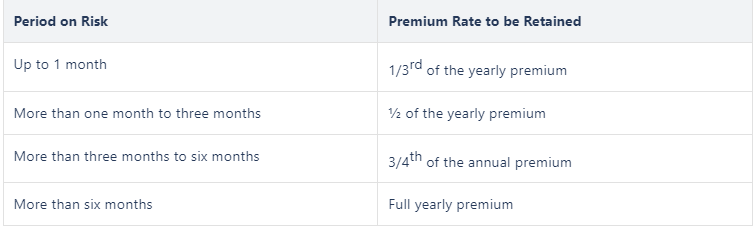

A policyholder can cancel this policy by giving a written notice period of 15 days and during this event, the company refunds the premium for the unexpired period of policy as mentioned below